E-Banking

What is electronic banking?

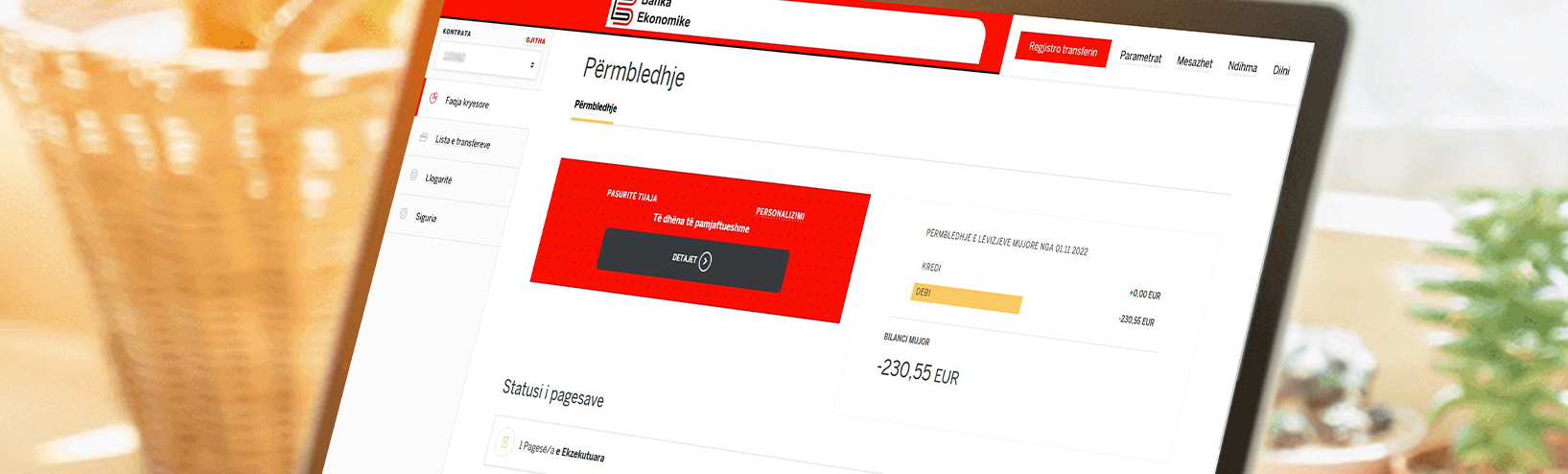

E-banking is a product designed for the purposes of online banking that enables you to have easy and safe access to your bank account.

E-banking is a safe, fast, easy and efficient electronic service that enables you access to bank account and to carry out online banking services, 24 hours a day, and 7 days a week.

With this service you save your time by carrying out banking transactions at any place and at any time, from your home or office, all you need is internet access. E-banking enables the following:

- Accurate statement of all means available in your bank account

- Statement of current account, credits, overdrafts and your deposits

- Execution of national and international transfers in various currencies

- Execution of all types of utility bill payments (electricity, water supply, telephone bills, etc..)

- Carrying out customs payments

- Electronic confirmation for all transactions executed by E-banking

- Management of your credit cards

How to apply?

All you need to do is visit one of our branch offices, and everything will be taken care of within only a few minutes.

Guidelines on e-Banking services

Download guidelines for using e-Banking services: here

Interbank transfers

The video manual for using E-banking services

E-banking security

One-time password (OTP)

One-time password or OTP is a unique password valid only for short time periods, which is used as additional security measure for online banking services.

This password is sent to your phone via message (SMS) and is valid for one use only.

You will receive an OTP, every time you want to access your e-banking account.

Safe Connection

Our Internet service is in accordance with international safety standards and is established with the most recent encryption specifications. This means that a safe connection is established every time you access our online services and your information given, can be accessed only by our banking system. No third party has access to these data.

Security Tips

In order to use e-banking services, it is recommended to choose a password containing a combination of letters, numbers, and symbols, with approximately 8 characters which is hard to guess or crack or be generated by malicious persons. Never give your access information (password or pin) to anyone, not even to the Bank employees. Never allow your browser (Internet Explorer, Chrome, Firefox, etc.) to save your password.

Keep your e-banking information safe, and never keep it in the same place with the Card or never write them down on paper. Make sure that you are accessing our website and not some other site and check the link in browser and the digital certificate on the top right corner in your browser.

Do not open the website via emails or other link that directs you to our website, but to be safer, always go directly to our website www.bekonomike.com and there click to access the e-banking.

Never install in the computer or phone any programs or programs under the name of Banka Ekonomike; our bank in no case requests this from you. These types of requests come from malicious persons aiming to steal your personal information. Do not install unsafe programs in your computer. Install an antivirus and update it regularly. Update your browser. Regularly check your account activity with E-Banking, and if you notice anything unusual or suspicious, immediately contact our bank at this phone number 038 500 500.

What is Phishing?

An organization or individual uses “Phishing” when they are trying to illegally obtain your personal information such as: your user ID, password, bank account numbers, credit card numbers, etc.

They will then use your information to access your account for illegal purposes, for example to commit fraud with credit cards, with your information that you erroneously gave to ‘phishing’ organization or individual person.

Common phishing techniques

The usual techniques that are used by phishing fraudsters include, but are not limited to: Sending emails from false email accounts, graphics and texts that look similar to those of the bank website or our email in order to fraud and collect sensitive personal information. They change the domain names in order to look alike to what we represent: @bekonomike.com. They try to access private information through one or more methods, such as false hyperlinks on websites or directly in email. For example, you may receive an email that claims to be from Banka Ekonomike, asking you to click on a link of a webpage to change or update your personal information for this or that reason. When you click on the link, you will be directed to a webpage that can be false but it looks quite similar with the webpage of the Bank, and there you may be requested to fill in your personal information.

These emails may look quite sophisticated and contain our design and logos. Never trust these emails. For security purposes, Banka Ekonomike will never send you an email asking you to fill in your personal information. How can these fraudulent emails look similar to our e-banking page? It is relatively simple to design a website similar to a legitimate website of any organization, only by copying the website template.

How can we prevent the phenomenon of phishing?

Do not click on any link to our e-Banking page in a suspicious e-mail. Our bank’s policy is never to send e-mail requesting personal information of customers or suggesting customers to access e-banking via e-mail. Every time you want to visit our e-banking, always do so directly from the address bar in your web browser. https://ebanking.bekonomike.com/.

Below are given some other important steps you need to follow in order to prevent yourself from being a victim of “phishing”: Never disclose your password, it is private. Do not give your personal details to any person or do not share them by E-mail or by phone. No Bank staff will ask you to provide your password or your personal details in this manner. If you receive an email that warns you that your account at Banka Ekonomike will be closed if you do not reconfirm your personal information, do not reply and do not click on the link in email. Avoid giving personal and financial information in e-mails. Before giving any financial information through the Internet, be aware that HTTPS appears in the address bar in browser, with the suffix S (secure). It shows that your information is secure during the transmission. Banka Ekonomike will never request personal and financial information by email. Fraudsters often will suggest you to make a payment as an evidence or test, but be careful because this may turn to be a real payment. Review your bank account balance via e-banking as often as possible to better monitor your account in order to remove suspicion on suspicious transactions. If you notice something suspicious, please do not hesitate and immediately contact our call centre 038 500 500. Your reporting will help us to prevent these negative phenomena.